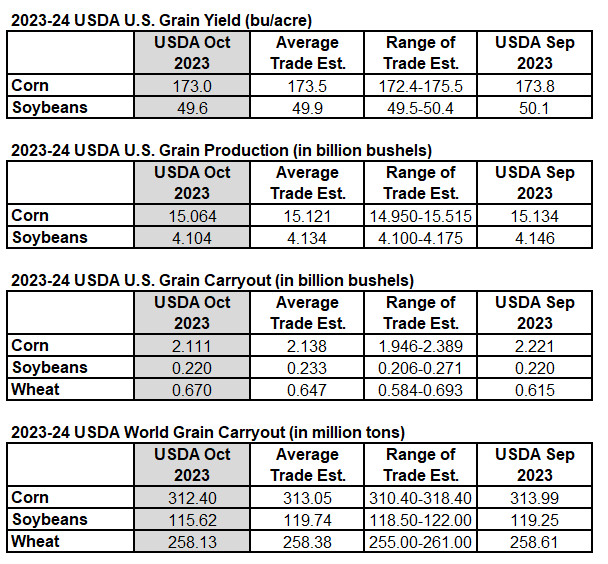

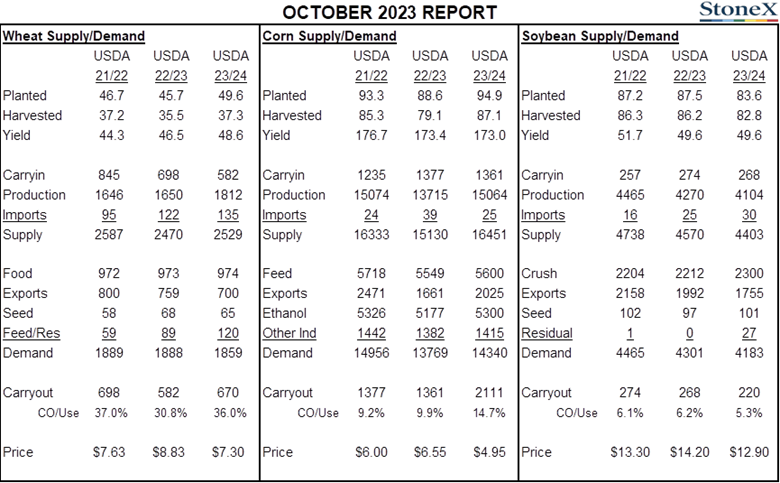

The USDA cut their US corn and soybean yield estimates slightly more than expected. Corn came in at 173.0 bpa, and beans at 49.6 bpa this month.

US corn and soybean carryout totals were both smaller than trade expected, while the US wheat carryout came in larger than expected.

The global carryout totals for corn, beans, and wheat were all smaller than trade expected.

Prices of corn, beans, and wheat were all trading higher 30 minutes following the reports, with beans seeing the largest gains.

From the USDA

COARSE GRAINS: This month?s 2023/24 U.S. corn outlook is for reduced supplies, lower feed and residual use and exports, and smaller ending stocks. Corn production is forecast at 15.064 billion bushels, down 70 million on a cut in yield to 173.0 bushels per acre.

Corn supplies are forecast at 16.451 billion bushels, a decline of 160 million bushels from last month, with lower production and beginning stocks. Exports are reduced 25 million bushels reflecting smaller supplies and slow early-season demand. Feed and residual use is down 25 million bushels based on lower supply.

With supply falling more than use, corn ending stocks for 2023/24 are lowered 110 million bushels. The season-average corn price received by producers is raised 5 cents to $4.95 per bushel.

The 2023/24 foreign coarse grain outlook is for slightly higher production, larger trade, and greater stocks relative to last month. Foreign corn production is higher on increases for Argentina, Moldova, the EU, and Paraguay.

Foreign corn ending stocks are higher, mostly reflecting increases for Ukraine and Moldova. Global corn stocks, at 312.4 million tons, are down 1.6 million.

Soybeans: US soybean production is forecast at 4.1 billion bushels, down 42 million on lower yields. Harvested area is unchanged at 82.8 million acres. The soybean yield is projected at 49.6 bushels per acre, down 0.5 bushels from the September forecast. The largest production changes are for Kansas, Michigan, and Nebraska.

Soybean exports are reduced 35 million bushels to 1.76 billion with increased competition from South America. Soybean crush is projected at 2.3 billion bushels, up 10 million, driven by higher soybean meal exports and soybean oil domestic demand. With lower exports partly offset by increased crush, ending stocks are unchanged from last month at 220 million bushels.

The U.S. season-average soybean price for 2023/24 is unchanged at $12.90 per bushel. Soybean meal and oil prices are unchanged at $380 per short ton and 63 cents per pound, respectively.

Global 2023/24 soybean exports are lowered 0.2 million tons to 168.2 million with lower exports for the United States partly offset by higher shipments for Brazil. Global soybean crush is increased 0.8 million tons to 328.5 million on higher crush for China and the United States. Global soybean ending stocks are lowered 3.6 million tons to 115.6 million mainly on lower stocks for China, Brazil, and India.

WHEAT: The outlook for 2023/24 U.S. wheat this month is for higher supplies, increased domestic use, unchanged exports, and higher ending stocks. Supplies are raised 85 million bushels, primarily on higher production as reported in the NASS Small Grains Annual Summary, released September 29.

Domestic use is raised 30 million bushels, all on higher feed and residual use. Exports remain at 700 million bushels with several offsetting by-class changes. Projected ending stocks are raised by 55 million bushels to 670 million, up 15 percent from last year.

The season-average farm price is reduced $0.20 per bushel to $7.30 on higher projected stocks and expectations for futures and cash prices for the remainder of the marketing year.

The global wheat outlook for 2023/24 is for reduced supplies, lower consumption, decreased trade, and lower stocks. Projected 2023/24 global ending stocks are lowered 0.5 million tons to 258.1 million, the lowest since 2015/16.

Source: USDA, Reuters

Source: USDA, StoneX